By: Austin Hein

Prices are on the rise, from gas to lumber to labor. Everything seems to just cost more than before.

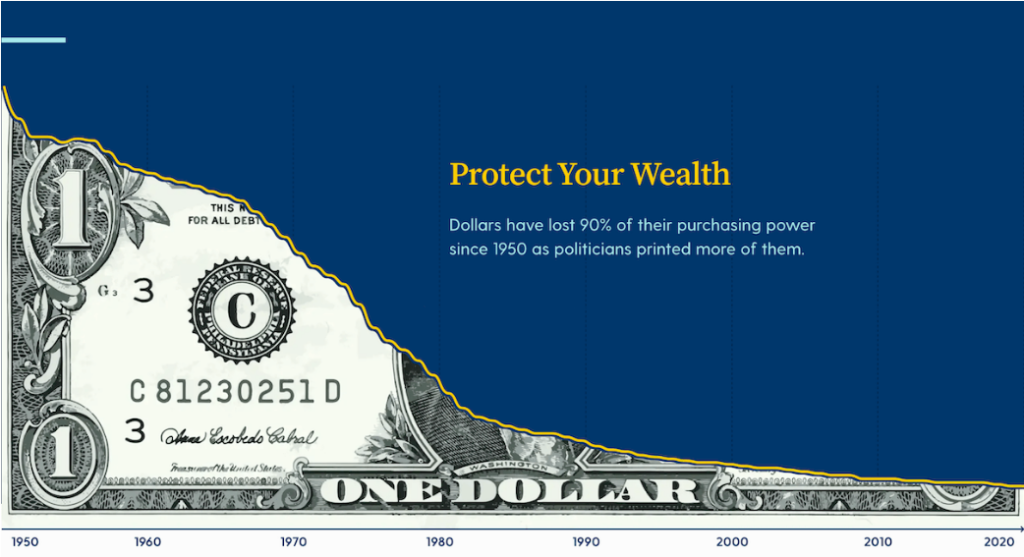

Back in my day, a gallon of milk cost $1.97, not the outrageous $2.62 we see today (lay off me, I’m not that old). I joke, but the rising costs of daily goods are a bit frightening. Many are wondering why this is, and there are a number of reasons, but ultimately it comes down to this – the U.S. Dollar is getting weaker.

A Dollar just isn’t what it used to be, and I’m not sure that’s going to get better any time soon.

What we’re experiencing is a phenomenon called inflation. It’s been going for a long time, but it’s happening now at a faster rate. And despite what Treasury Secretary Janet Yellen and her Keynesian pals say, it’s a problem.

There are two driving factors that are causing this. 1. Government Spending and 2. The Federal Reserve’s monetary policy.

Let’s talk about government spending. The United States government added more than $10 Trillion in debt last year alone. These spending packages were deemed “necessary” to combat the economic downturn from the pandemic, which, sure. The pandemic left tens of thousands of Americans in the unemployment line. Businesses were tanking, families were starving, and yes, people were desperate for relief.

What Congress came back with was a multi-trillion-dollar spending package that included unprecedented amounts of corporate subsidies and bailouts – oh, and some crumbs for the peasants.

Spending what you don’t have has consequences. Period. Lately, Socialists have been peddling something called “Modern Monetary Theory” (MMT). This is a bogus economic theory that basically says money doesn’t matter when you’re the one printing the money. Thus: spend baby, spend. MMT is gaining popularity. Its biggest believers have even landed themselves jobs in prominent political campaigns a la Bernie Sanders.

But here’s the thing: throwing money at anything and everything causes the value of the dollar to decline; it’s just fact. And this leads me to my second point – the Fed.

The Federal Reserve has controlled the money supply since its inception in 1913, but the Fed has gained massive power over the years. Since the United States ditched the Gold Standard in 1972, the Fed board has become the single most powerful group of people in the country – and they aren’t even elected.

Without getting into the technical details of buying and selling bonds, I’ll simplify it in saying that the Fed basically prints money.

And when the printers are moving, you’re losing.

Back when the dollar was on the Gold Standard, the value tied directly to a solid commodity that was less subject to fluctuation. But now, with the free-floating dollar, the Fed is the only thing stopping us from hyperinflation.

With Fed actions to “pay for” Congressional spending, there is no limit to the damage that can be done to the dollar.

It’s no wonder why cryptocurrencies like Bitcoin and Ethereum (no, not Dogecoin) are gaining steam – people are losing faith in the dollar and are looking for a way out. These cryptocurrencies can’t inflate like the dollar, given the blockchain restrictions.

The United States needs to reverse course and reestablish responsible fiscal and monetary policies, and yes, that means ending the Fed.

Quick Poll:

More from America’s Citizen Press

More you might like